Are you desperately looking for 'income taxation essay'? You can find all the material on this web page.

Table of contents

- Income taxation essay in 2021

- Personal income tax

- Essay on taxation

- Federal income taxation of corporations

- Importance of taxation essay

- Disadvantages of reducing income tax

- How to compute individual income tax

- Disadvantages of increasing income tax

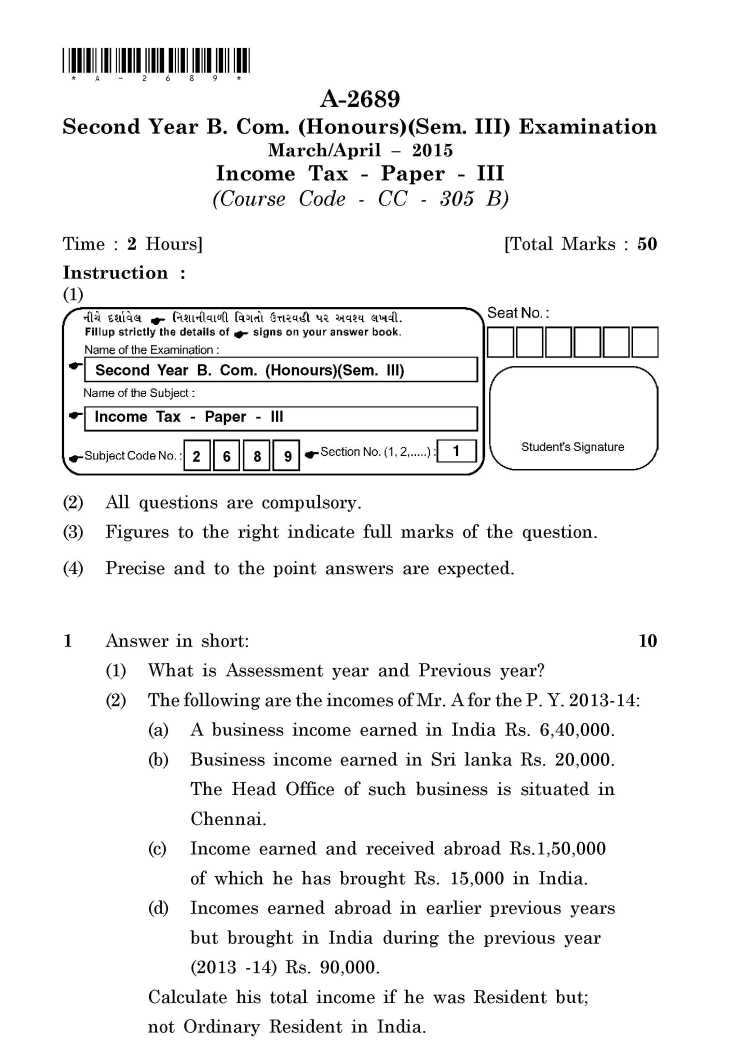

Income taxation essay in 2021

This image shows income taxation essay.

This image shows income taxation essay.

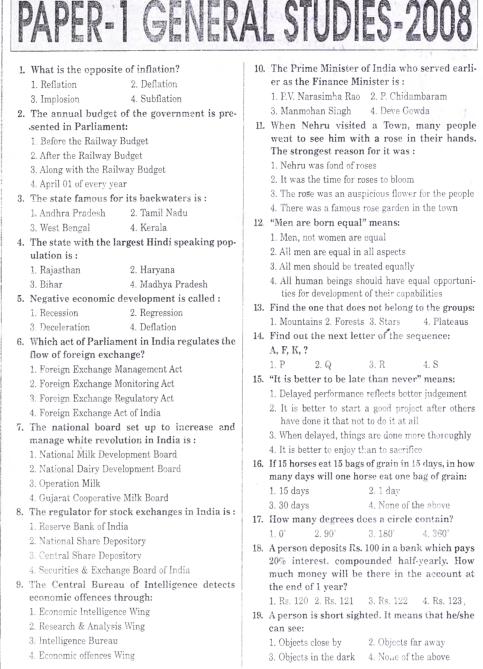

Personal income tax

This picture representes Personal income tax.

This picture representes Personal income tax.

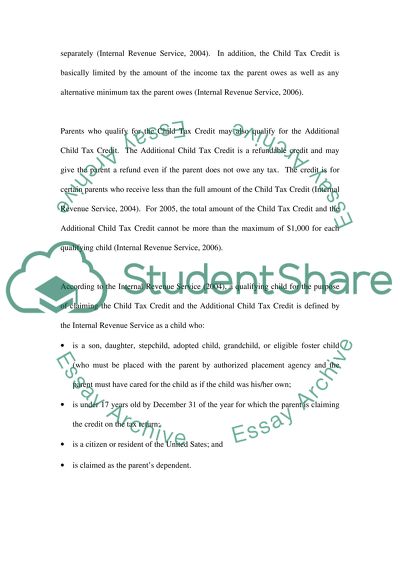

Essay on taxation

This image shows Essay on taxation.

This image shows Essay on taxation.

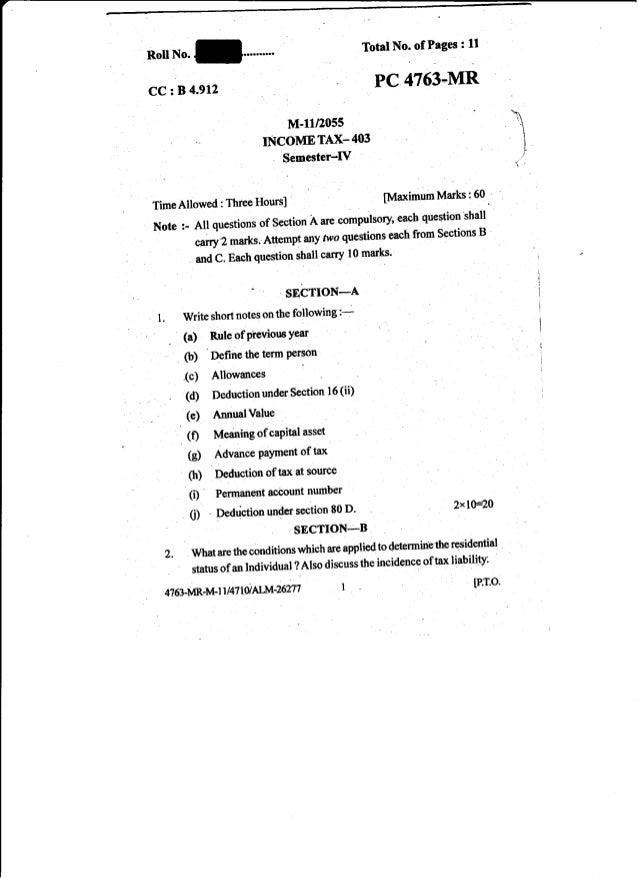

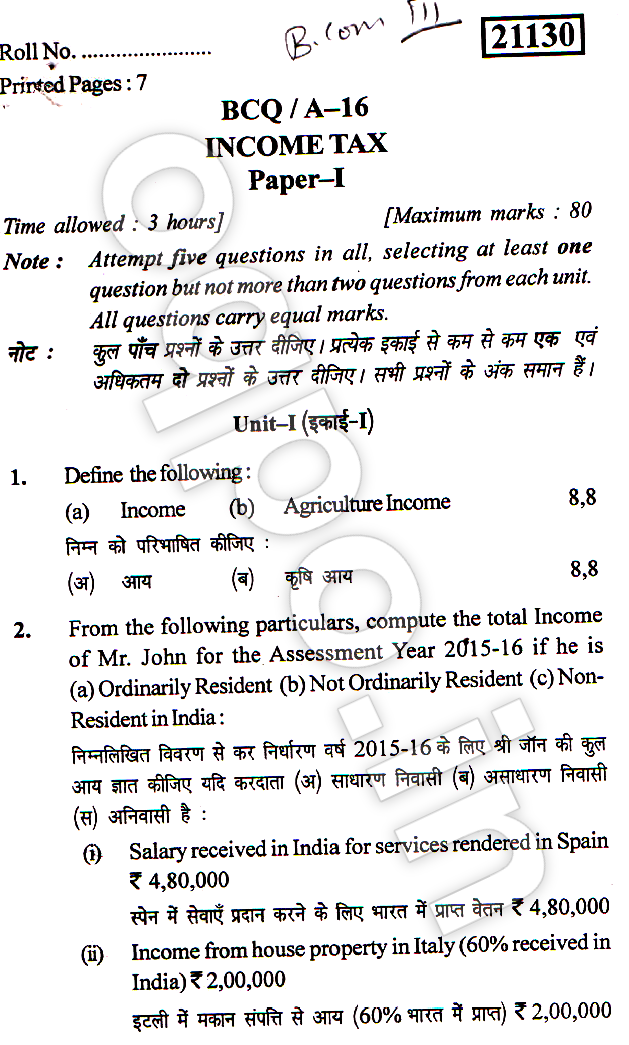

Federal income taxation of corporations

This picture illustrates Federal income taxation of corporations.

This picture illustrates Federal income taxation of corporations.

Importance of taxation essay

This picture shows Importance of taxation essay.

This picture shows Importance of taxation essay.

Disadvantages of reducing income tax

This picture demonstrates Disadvantages of reducing income tax.

This picture demonstrates Disadvantages of reducing income tax.

How to compute individual income tax

This image representes How to compute individual income tax.

This image representes How to compute individual income tax.

Disadvantages of increasing income tax

This image representes Disadvantages of increasing income tax.

This image representes Disadvantages of increasing income tax.

How does the income tax work in real life?

In contrast, the income tax does not actually work in the theoretical sense, because people from the higher income brackets do not pay the higher taxes. Since the society changes rapidly, the income sources have also changed and the number of ways to do tax evasions are increasing.

How is the income tax a useful function?

Therefore, the income tax is performing as a useful function providing the quality of lifestyles for citizens. In contrast, the income tax does not actually work in the theoretical sense, because people from the higher income brackets do not pay the higher taxes.

What are the advantages and disadvantages of income taxes?

In conclusion, the tax can become a main earning source for the government for the provision of various public services. Since the taxation cannot cope with the changing of earning methods, the income tax is not efficient. More about this topic ...

How many words are in an essay on government taxation?

Every statute which takes away or impairs rights acquired under existing laws, or creates a new obligation or imposes a new duty, or attaches a new disability in respect of transactions already passed , must be presumed to be intended not Should The Uk Government Restore The 50 % Additional Rate Of Income Tax? Essay

Last Update: Oct 2021